Asian share rise on US rally, jobs data signaling low rates

Asian shares opened the week higher, cheered by a rally on Wall Street as a grim jobs report signaled to investors that interest rates will likely stay low

May 10, 2021, 3:23 AM

3 min read

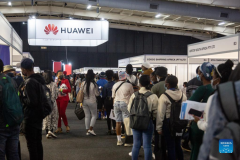

As a vehicle drives by, a woman wearing a protective mask stands in front of an electronic stock board showing Japan's Nikkei 225 index at a securities firm Monday, May 10, 2021, in Tokyo. Asian shares rose Monday, cheered by a rally on Wall Street as a grim jobs report signaled to investors that interest rates will likely stay low. (AP Photo/Eugene Hoshiko)

TOKYO -- Asian shares rose Monday, cheered by a rally on Wall Street as a grim jobs report signaled to investors that interest rates will likely stay low.

Japan's Nikkei 225 rose 1.0% in morning trading to 29,644.96. Australia's S&P/ASX 200 jumped 1.2% to 7,166.10. South Korea's Kospi added 1.0% to 3,230.35. Hong Kong's Hang Seng edged up 0.4% to 28,729.22, while the Shanghai Composite was little changed but inched up to 3,418.95.

The regional gains are coming despite a recent surge in coronavirus infections in Asia.

In Japan, worries are growing about tens of thousands of athletes and officials entering the country for the Tokyo Olympics, set to open in July. Many will be from countries where people have been vaccinated, while the rollout has been extremely slow in Japan, with about 3% of the population inoculated so far. The Tokyo Olympics organizers are promising stringent measures to prevent clusters and testing the athletes and officials regularly for infections.

Yeap Jun Rong, market strategist for IG in Singapore, said investors are watching for inflation and retail sales data out of the U.S. and for British economic growth data.

The S&P 500 index rose 0.7% to 4,232.60, its third straight gain, and topping the previous all-time high set last month. The Dow Jones Industrial Average gained 0.7% to 34,777.76, setting a record high for the third straight day. The Nasdaq composite picked up 0.9%, to 13,752.24.

Small company stocks also got a solid bump. The Russell 2000 index outgained the major stock indexes, climbing 1.4% to 2,271.63.

The economy is regaining momentum as the rate of coronavirus vaccinations rises but Friday's U.S. jobs report was a massive disappointment. The market's most anticipated economic data of each month, it showed employers added just 266,000 jobs in April. That was far fewer than the 975,000 jobs that economists expected and a steep slowdown from March’s hiring pace of 770,000.

The weak jobs number bolsters the case for the Federal Reserve to keep interest rates low.

Such low interest rates have been a huge reason for the stock market's recovery from its pandemic low in March 2020. Investors have fretted that a supercharged economy could lead to higher, persistent inflation, forcing the U.S. central bank to raise rates. The Fed has been holding short-term rates at a record low and buying $120 billion in bonds every month.

Recent relatively strong global earnings reports have lifted share prices. Among companies reporting earnings later this week are Japanese automakers Toyota Motor Corp., Honda Motor Co. and Nissan Motor Co.

In energy trading, benchmark U.S. crude added 79 cents to $65.69 a barrel. It gained 19 cents to $64.90 per barrel on Friday. Brent crude, the international standard, gained 85 cents to $69.13 a barrel.

In currency trading, the U.S. dollar rose to 108.87 Japanese yen from 108.59 yen late Friday. The euro weakened to $1.2163 from $1.2167.

Comments (0)

Top Stories

6 people dead including alleged gunman after mass shooting in Colorado

May 09, 7:22 PM